2025 Tax Table Married Filing Jointly Brackets - 2025 Tax Brackets For Married Filing Jointly Beginning Of Ramadan 2025, Your bracket depends on your taxable income and filing status. Tax Brackets Definition, Types, How They Work, 2025 Rates, Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate returns, and estates and trusts.

2025 Tax Brackets For Married Filing Jointly Beginning Of Ramadan 2025, Your bracket depends on your taxable income and filing status.

The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2). Compare your take home after tax an.

Tax Rates Heemer Klein & Company, PLLC, Single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child.

2025 Tax Brackets Announced What’s Different?, 2025 us tax tables with 2025 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.

IRS Here are the new tax brackets for 2023, Efile your massachusetts tax return now.

Anh Le's Tax Planning Guide 2025 Tax Planning Guide Brackets and Rates, Single filers age 65 or older who are not surviving spouses may increase their standard deduction by $1,950 and married filing jointly filers may increase their standard deduction by $1,550 for each spouse age 65 or older.

Tax Brackets Definition, Types, How They Work, 2025 Rates, The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

2025 Tax Table Married Filing Jointly Brackets. Tax bracket tax rate ; Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate returns, and estates and trusts.

The 2023 Tax Brackets By Modern Husbands Free Nude Porn Photos, Single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child.

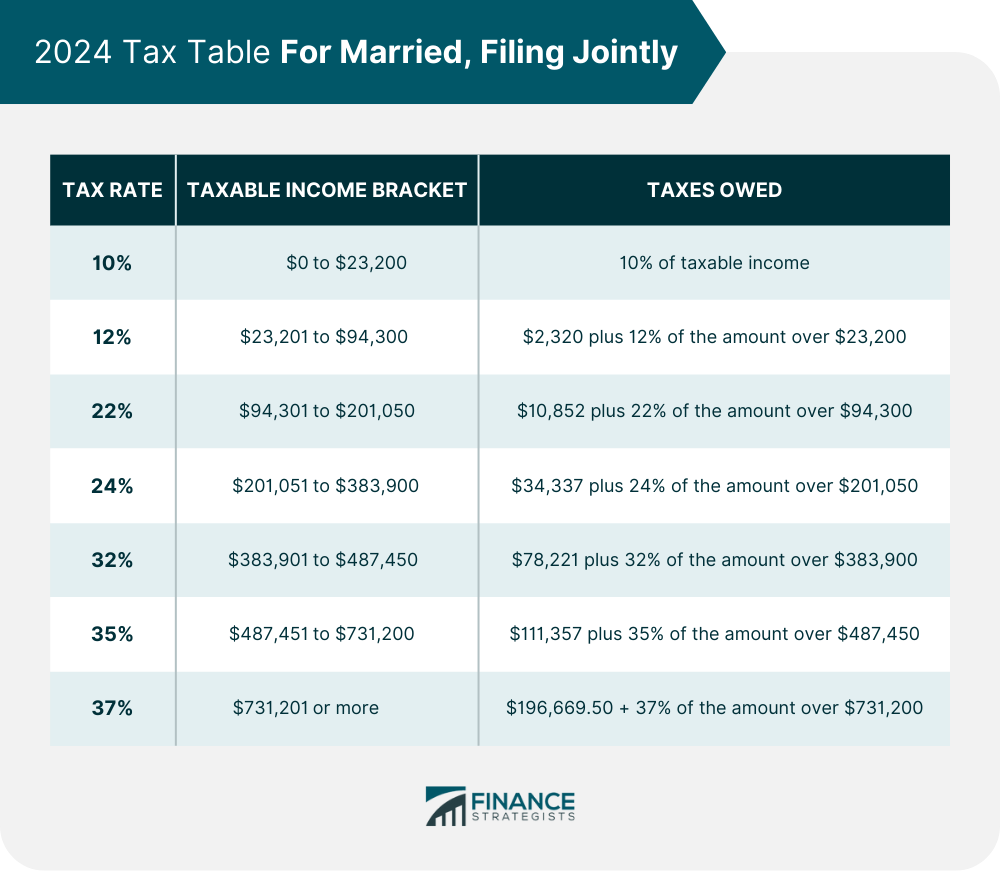

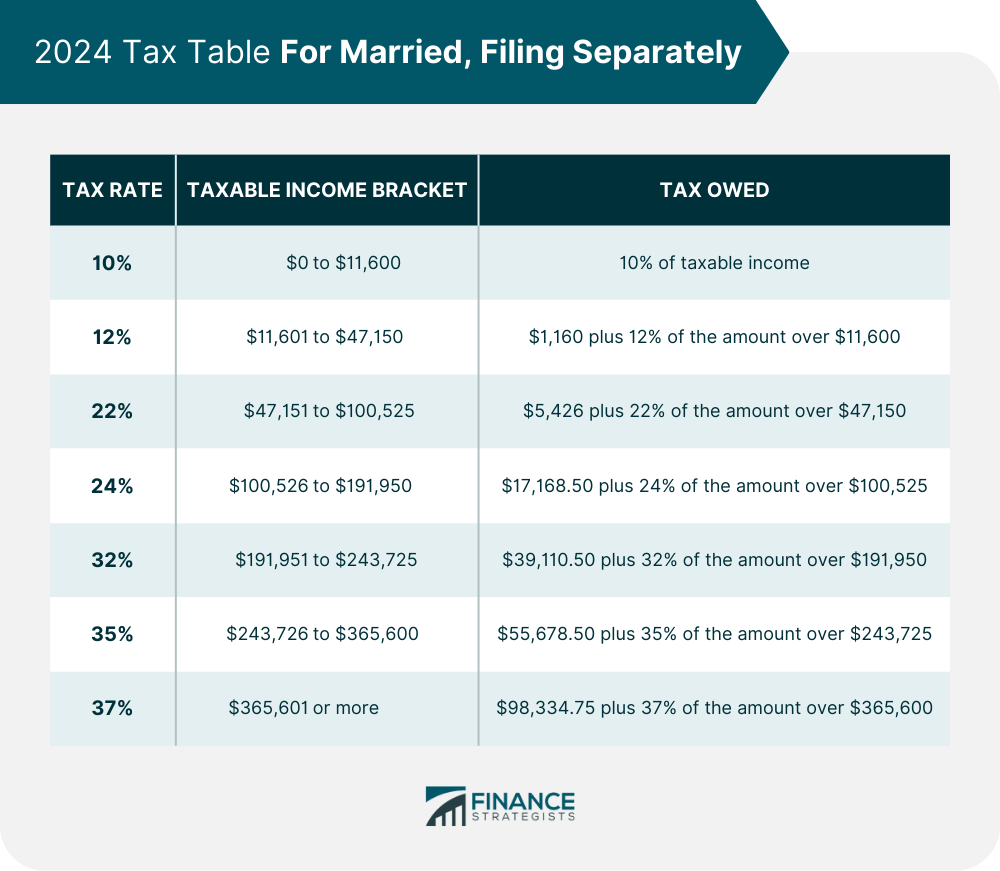

Exploring The Question, “What Is My Tax Bracket?” Blue Chip Partners, For example, if you’re married filing jointly for 2025 taxes with a taxable income of $95,000, you’d fall under the 22% tax bracket even though a majority of your taxable income ($94,300) falls under the 12% tax bracket.

2025 Tax Reform Changes What You Need To Know Scott M. Aber, CPA PC, The table below shows the tax bracket/rate for each income level: